International Compensation - B Com Hons Final Year Students

Designing and developing a better compensation package for HR professionals for the international assignments requires knowledge of taxation, employment laws, and foreign currency fluctuation by the HR professionals. Moreover, the socio-economic conditions of the country have to be taken into consideration while developing a compensation package. It is easy to develop the compensation package for the parent country national but difficult to manage the host and third country nationals. When a firm develops international compensation policies, it tries to fulfills some broad objectives:

- The compensation policy should be in line with the structure, business needs and overall strategy of the organization.

- The policy should aim at attracting and retaining the best talent.

- It should enhance employee satisfaction.

- It should be clear in terms of understanding of the employees and also convenient to administer.

The employee also has a number of objectives that he wishes to achieve from the compensation policy of the firm

- He expects proper compensation against his competency and performance level.

- He expects substantial financial gain for his own comfort and for his family also.

- He expects his present and future needs to be taken care of including children’s education, medical protection and housing facilities.

- The policy should be progressive in nature.

Major Components in an International Compensation Package

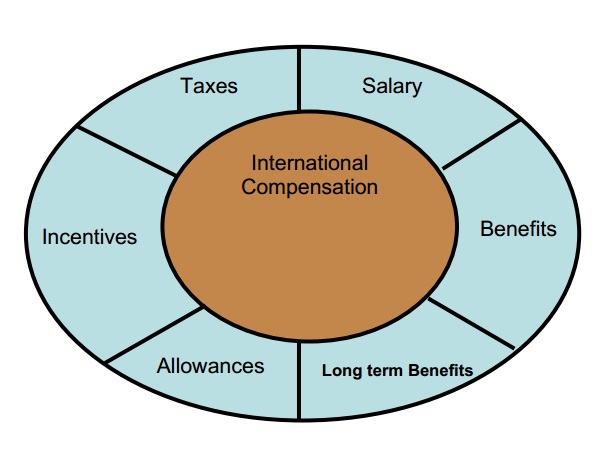

International Compensation is an internal rate of return (monetary or non monetary rewards / package) including base salary, benefits, perquisites and long term & short term incentives that valued by employee’s in accordance with their relative contributions to performance towards achieving the desired goal of an organization.

The following are the major components of an international compensation package.

1. Base Salary

This term has a slightly different meaning in an international context than in a domestic one. In the latter case, it denotes the amount of cash compensation that serves as a benchmark for other compensation elements like bonus, social benefits. For the expatriate, it denotes the main component of a package of allowances directly related to the base salary and the basis for in-service benefits and pension contributions. Base salary actually forms the foundation block of the international compensation.

2. Foreign Service Inducement Premium

This is a component of the total compensation package given to employees to encourage them to take up foreign assignments. This is with the aim to compensate them for the possible hardships they may face while being overseas. In this context, the definition of hardship, the eligibility criteria for premium and the amount and timing of this payment are to be carefully considered. Such payments are normally made in the form of a percentage of the salary and they vary depending upon the tenure and content of the assignment. In addition, sometimes other differentials may be considered. For instance: if a host country’s work week is longer that of the home country, a differential payment may be made in lieu of overtime.

3. Allowances

One of the most common kinds of allowance internationally is the Cost of Living Allowance (COLA). It typically involves a payment to compensate for the differences in the cost of living between the two countries resulting in an eventual difference in the expenditure made. A typical example is to compensate for the inflation differential. COLA also includes payments for housing and other utilities, and also personal income tax. Other major allowances that are often made are:

- Home leave allowance

- Education allowance

- Relocation allowance

- Spouse assistance (compensates for the loss of income due to spouse losing their job)

Thus, multinationals normally pay these allowances to encourage employees to take up international assignments to make sure that they are comfortable in the host country in comparison to the parent country.

4. Benefits

The aspect of benefits is often very complicated to deal with. For instance, pension plans normally differ from country to country due to difference in national practices. Thus all these and other benefits (medical coverage, social security) are difficult to imitate across countries.

Thus, firms need to address a number of issues when considering what benefits to give and how to give them. However, the crucial issue that remains to be dealt with is whether the expatriates should be covered under the home country benefit programmes or the ones of the host country. As a matter of fact, most US officials are covered by their home country benefit programmes. Other kinds of benefits that are offered are:

- Vacation and special leaves

- Rest and rehabilitation leaves

- Emergency provisions like death or illness in the family

These benefits, however, depend on the host country regulations.

5. Incentives

In recent years some MNC have been designing special incentives programmes for keeping expatriate motivated. In the process a growing number of firms have dropped the ongoing premium for overseas assignment and replaced it with on time lump-sum premium. The lump-sum payment has at least three advantages. First expatriates realize that they are paid this only once and that too when they accept an overseas assignment. So the payment tends to retain its motivational value. Second, costs to the company are less because there is only one payment and no future financial commitment. This is so because incentive is separate payment, distinguishable for a regular pay and it is more readily for saving or spending.

6. Taxes

The final component of the expatriate’s compensation relates to taxes. MNCs generally select one of the following approaches to handle international taxation.

- Tax equalization: – Firm withhold an amount equal to the home country tax obligation of the expatriate and pay all taxes in the host country.

- Tax Protection :- The employee pays up to the amount of taxes he or she would pay on remuneration in the home country. In such a situation, The employee is entitled to any windfall received if total taxes are less in the foreign country then in the home country.

7. Long Term Benefits or Stock Benefits

The most common long term benefits offered to employees of MNCs are Employee Stock Option Schemes (ESOS). Traditionally ESOS were used as means to reward top management or key people of the MNCs. Some of the commonly used stock option schemes are:

- Employee Stock Option Plan (ESOP)- a certain nos. of shares are reserved for purchase and issuance to key employees. Such shares serve as incentive for employees to build long term value for the company.

- Restricted Stock Unit (RSU) – This is a plan established by a company, wherein units of stocks are provided with restrictions on when they can be exercised. It is usually issued as partial compensation for employees. The restrictions generally lifts in 3-5 years when the stock vests.

- Employee Stock Purchase Plan (ESPP) – This is a plan wherein the company sells shares to its employees usually, at a discount. Importantly, the company deducts the purchase price of these shares every month from the employee’s salary.

Hence, the primary objective for providing stock options is to reward and improve employee’s performance and /or attract / retain critical talent in the Organization.

Comments

Post a Comment