scanning the IBE

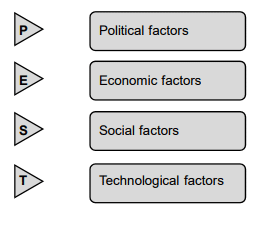

PEST ANALYSIS:

PEST analysis is an analysis of the political, economic, social & technological factors in the external environment of an organization, which can affect its activities & performance. PEST analysis (Political, Economic, Social & Technological analysis) describes a framework of macro-environmental factors used in the environmental scanning component of international business management. It is a part of the external environmental analysis, & gives an overview of the different macroenvironmental factors that the company has to take into consideration. It is a useful strategic tool for understanding the market growth or decline, business position, potential & direction for operations.

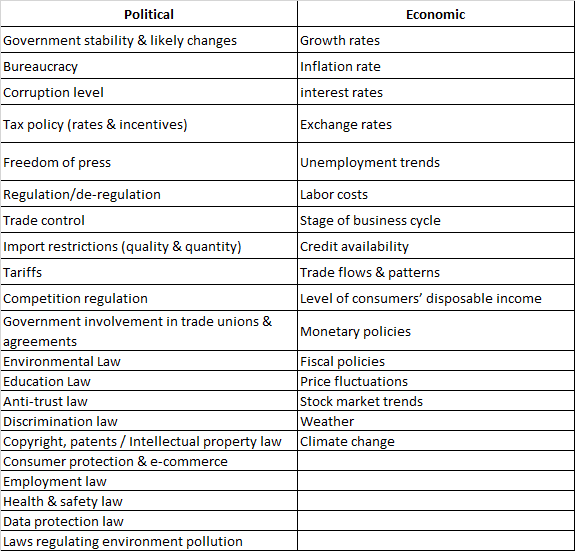

- Political factors are principal to what degree the government intervenes in the economy. Specifically, political factors include areas such as tax policy, the labor law, environmental law, trade restrictions, tariffs, & the political stability. Political factors may also include goods & services which the government wants to provide or be provided (merit goods) & those that the government does not want to be provided (demerit goods or merit bads). Furthermore, governments have great influence on the health, education, & infrastructure of a nation.

- Economic factors include economic growth, interest rates, exchange rates & the inflation rate. These factors have major impacts on how businesses operate & make decisions. For example, interest rates affect a firm’s cost of capital & therefore to what extent a business grows & expands. Exchange rates affect the costs of exporting goods & the supply & price of imported goods in an economy.

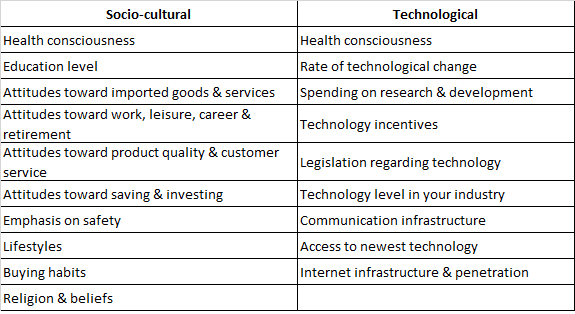

- Social factors include the cultural aspects & include health consciousness, population growth rate, age distribution, career attitudes & emphasis on safety. Trends in the social factors affect the demand for a company’s products & how that a company operates. For example, an aging population may imply a smaller & less-willing workforce (thus increasing the cost of labor). Furthermore, companies may change numerous management strategies to adapt to these social trends (such as recruiting the older workers).

- Technological factors include technological aspects such as R & D activity, automation, technology incentives & the rate of technological change. They can determine barriers to entry, minimum efficient production level & influence outsourcing decisions. Furthermore, technological shifts can affect costs, quality, & lead to innovation. Harvard professor Francis Aguilar is thought to be the creator of PEST Analysis. He encompassed the scanning tool called ETPS in his 1967 book “Scanning the Business Environment.” The name was later tweaked to create the current acronym PEST.

Benefits

PEST Analysis is useful for four main reasons:

- It helps to spot business or personal opportunities, & it gives advanced warning of significant threats.

- It reveals the direction of change within the business environment. This helps to shape the business accordingly.

- It helps avoid starting the projects that are likely to fail, for reasons beyond the control of firms.

- It helps to develop an objective view of the new environment while entering a new country, region, or market.

Gathering information is the first important step in doing PEST analysis. Once it is done, the information has to be evaluated. There are many factors changing in the external environment but not all of them are affecting or might affect the organization. Therefore, it is essential to identify which PEST factors represent the opportunities or threats for an organization & list only those factors in PEST analysis. This agrees to focus on the most important changes that might have the impact on the company.

Factors to be considered

- Political Factors to Consider

- Economic Factors to Consider

- Socio-Cultural Factors to Consider

- Technological Factors to Consider

PEST analysis template

PEST variations

PEST analysis is the most general version of all PEST variations created. It is the very vibrant tool as a new component can be easily added to it so as to focus on 1 or another critical force affecting the company.

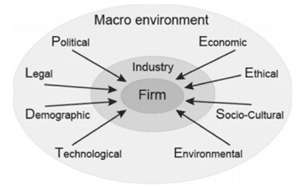

2. PESTEL MODEL

It involves the collection & portrayal of information about internal & external factors which have, or may have, an impact on business. PESTEL analysis is the simple & the effective tool that is used in a situation analysis to identify the key external (the macro environment level) forces that might affect the organization. These forces can create both opportunities & threats for an organization. PESTEL model is PEST including legal, environmental, ethical & demographic forces.

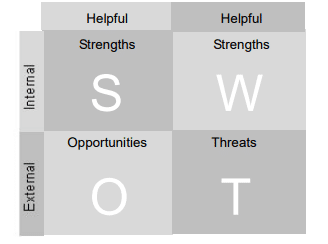

3. SWOT ANALYSIS

It is an analysis of an organization’s strengths & weaknesses alongside the opportunities & threats present in the external environment. It involves the collection & portrayal of information about internal & external factors which have, or may have, an impact on business. It is a framework that allows managers to synthesize insights obtained from an internal analysis of the company’s strengths & weaknesses with those from an analysis of external opportunities & threats. SWOT is an acronym which stands for:

- Strengths: the factors that give an edge for the company over its competitors.

- Weaknesses: factors that can be harmful if used against the firm by its competitors.

- Opportunities: favorable situations which can bring a competitive advantage.

- Threats: unfavorable situations which can negatively affect the business.

Strengths & weaknesses are internal to the company & can be directly managed by it, while the opportunities & threats are external & the company can only anticipate & react to them. Often, SWOT is presented in the form of a matrix as in the diagram as below:

Benefits: SWOT tool has 5 key benefits:

- Simple to do & practical to use;

- Clear to understand;

- Focuses on the key internal & external factors affecting the company;

- Helps to identify future goals;

- Initiates further analysis.

Limitations

Although there are clear benefits of doing the analysis, many managers & academics heavily criticize or don’t even recognize it as a serious tool. In relation to many, it is the ‘low-grade’ analysis. Here are the chief flaws identified by the research:

- Excessive lists of strengths, weaknesses, opportunities & threats;

- No prioritization of factors;

- Factors are described too broadly;

- Factors are often opinions, not facts;

- No recognized method to distinguish between strengths & weaknesses, opportunities & threats.

Guidelines for successful SWOT

The following guidelines are very important in writing a successful SWOT analysis. They eliminate most of SWOT limitations & improve it significantly:

- Factors have to be identified relative to the competitors. It allows specifying whether the factor is a strength or a weakness.

- List of 5 – 10 items for each of the category. Prevent creating too short or an endless list.

- Items must be clearly defined & as specific as possible.

For example, firm’s strength is a brand image (vague); strong brand image (more precise); brand image valued at $10 billion, which is the most valued brand in the market (very good).

- Rely on facts not opinions. Find some external information or involve someone who could provide an unbiased opinion.

- Factors should be action orientated. For example, “slow introduction of new products” is an action orientated weakness.

Performing the analysis?

The SWOT can be carried on by 1 person or the group of members who are directly responsible for the situation assessment in a company. Basic SWOT analysis is done fairly easily & comprises of only a few steps:

Step 1: Listing the firm’s key strengths & weaknesses

- Strengths & weaknesses are the factors of the firm’s internal environment.

- When looking for strengths, ask “what do you do better or have more value than your competitors have?”

- In case of the weaknesses, ask “what could you improve & at least catch up with your competitors?”

- Strengths & weaknesses can be identified by the firm’s

- Resources: l&, equipment, knowledge, br& equity, intellectual property, etc.

- Core competencies

- Capabilities

- Functional areas: management, operations, marketing, finances, human resources & R&D

- Organizational culture

- Value chain activities

- Any internal factor can be either strength or weakness. The manager will have to analyses it depending on the available information & circumstances. A resource can be seen as a strength if it exhibits VRIO (valuable, rare & cannot be imitated) framework characteristics. Or else, it doesn’t provide any of the strategic advantages for the company For example: – “Brand image” might be the weakness if a company has a poor brand image. However, it can also be the strength if the company has a most valuable brand in the market.

- 17% profit margin would be an excellent margin for many firms in most industries & it would be considered as strength. But what if the average profit margin of your competitors is 20%? The company’s 17% profit margin would be considered as a weakness.

Step 2: Identifying opportunities & threats – Opportunities & threats are the external uncontrollable factors.

- They arise due to the changes in the macro environment, industry or competitors’ actions.

- Opportunities represent the external situations that bring a competitive advantage if seized upon.

- Threats damage your company so you would better avoid or defend against them.

- Any external factor can be either strength or weakness. The manager will have to analyses it depending on the available information & circumstances. The organization can only guess the outcome & count on analysts’ forecasts. For example, exchange rates may increase or reduce the profits from exports, depending if the exchange rate of currency will rise (opportunity) or fall (threat) against the other currencies.

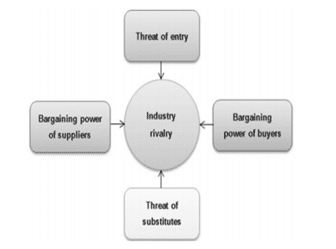

4. PORTER’S FIVE FORCES MODEL

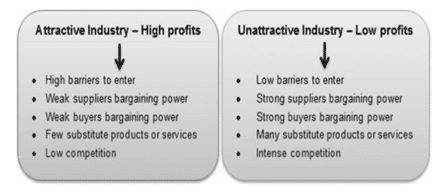

Porter’s five forces model is an analysis tool that uses 5 forces to determine the profitability of an industry & shape a firm’s competitive strategy. It is a framework that classifies & analyzes the most important forces affecting the intensity of competition in an industry & its profitability level. 5 forces model was created by the Michael Porter in 1979 to understand how 5 key competitive forces are affecting the industry. The 5 forces identified are:

The threat of new entrants: This force determines how easy (or not) it is to enter a particular industry. If an industry is profitable & there are almost few barriers to enter & the rivalry soon increases. When most organizations compete for the same market share, profits start to fall. It is essential for existing organizations to create high barriers to entry to deter new entrants.

The threat of new entrants is high when:

- Low amount of the capital is required to enter the market;

- Existing companies can do little to hit back;

- Existing firms don’t retain the patents, the trademarks or don’t have established brand reputation;

- There is no government regulation;

- Customer switching costs are low (it doesn’t cost a lot of money for a firm to switch to other industries);

- There is low customer loyalty;

- Products are nearly identical;

- Economies of scale can be easily achieved.

Bargaining power of suppliers: Strong bargaining power permits the suppliers to sell the higher priced or the low-quality raw materials to their buyers. This directly affects a buying firms’ profits because it has to pay more for the materials. The Suppliers have strong bargaining power when:

- There are few suppliers but many buyers;

- Suppliers are large & threaten to forward integrate;

- Few substitute raw materials exist;

- Suppliers hold scarce resources;

- Cost of switching raw materials is especially high.

Bargaining power of buyers: Buyers have the power to demand a lower price or a higher product quality from the industry producers when their bargaining power is strong. Lower price means the lower revenues for the producer, while the higher quality products usually raise the production costs. Both scenarios result in lower profits for producers. Buyers exert strong bargaining power when:

- Buying in large quantities or control many access points to the final customer;

- Only a few buyers exist;

- Switching costs to other supplies are low;

- They threaten to backward integrate;

- There are many substitutes;

- Buyers are price sensitive.

The threat of substitutes: This force is especially threatening when buyers can easily find substitute products with attractive prices or better quality & when buyers can switch from one product or service to another with little cost. For example, to switch from a coffee to tea doesn’t cost anything, nothing like switching from the car to a bicycle. Rivalry among existing competitors: This force is the major determinant of how competitive & profitable an industry is. In the competitive industry, the firms have to compete hostilely for a market share, which results in low profits. Rivalry among the competitors is intense when:

- There are many competitors;

- Exit barriers are high;

- Industry of growth is slow or negative;

- Products are not differentiated & can be easily substituted;

- Competitors are of equal size;

- Low customer loyalty.

Although Porter originally introduced five forces affecting an industry, scholars have suggested including the sixth force: complements. Complements increase the demand for the primary product with which they are used, thus, increasing firm’s & industry’s profit potential.

Comments

Post a Comment